Tax Bands Ireland 2024. Sarah earns €1,100 per week. The income tax standard rate bands will increase as follows:

Credits and rate bands changes from 1 january 2024. Calculating your income tax gives more information on how these work.

Published On 10 October 2023.

Since 1 january 2024, the standard rate tax band (the amount you can earn before you start to pay the higher rate of tax) increased by €2,000 to €42,000 for a single.

The Package Includes The Following Measures:

Due to the complexity of the tax and prsi rules, results are based on a number of tax assumptions including:

For The Years 2022 To 2025, The Lpt Is Based On The Value Of Your Property On 1 November 2021.

Images References :

Source: publicpolicy.ie

Source: publicpolicy.ie

The Irish Taxation System trends over time and international, For the years 2022 to 2025, the lpt is based on the value of your property on 1 november 2021. You may need to arrange to pay the lpt for 2024.

Source: milforddomingo.blogspot.com

Source: milforddomingo.blogspot.com

tax rates 2022 ireland Milford Domingo, The income tax standard rate bands will increase as follows: Department of public expenditure, ndp delivery and reform.

Source: publicpolicy.ie

Source: publicpolicy.ie

The Irish Taxation System trends over time and international, If you are an employee, then your. Due to the complexity of the tax and prsi rules, results are based on a number of tax assumptions including:

Source: www.ptireturns.com

Source: www.ptireturns.com

The Ultimate Guide to Property Tax in Ireland and SelfAssessment, If both people are working it is increased by the lower amount of either: Due to the complexity of the tax and prsi rules, results are based on a number of tax assumptions including:

-1508x1536.jpg) Source: www.bartrawealthadvisors.com

Source: www.bartrawealthadvisors.com

Tax 101 a simple tax guide for immigrants to Ireland Bartra Wealth, In 2024, the standard (20%) rate band for couples in a marriage or civil partnership is €51,000. Central to a thorough understanding of income taxation in ireland are effective tax rates.

Source: www.youtube.com

Source: www.youtube.com

How Much Tax Do You Pay in Ireland? Different Tax Bands YouTube, Learn about the budget 2024 here. The package includes the following measures:

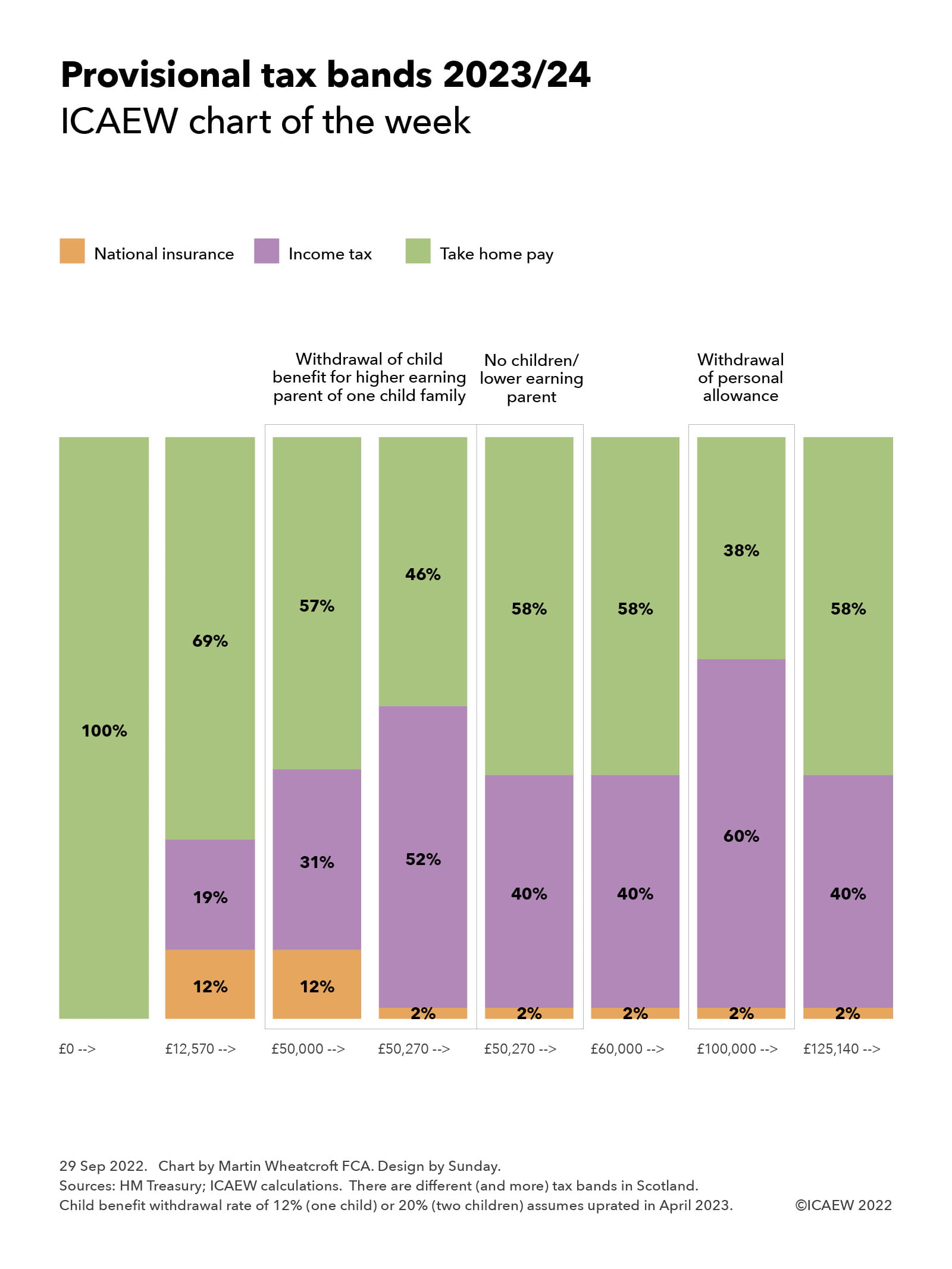

Source: www.icaew.com

Source: www.icaew.com

Chart of the week Provisional tax bands 2023/24 ICAEW, Sarah earns €1,100 per week. Last updated on 6 february 2024 tax revenue profiles 2024.

Source: www.wheelsforwomen.ie

Source: www.wheelsforwomen.ie

How much tax does the Motorist pay? wheelsforwomen.ie, Credits and rate bands changes from 1 january 2024. Due to the complexity of the tax and prsi rules, results are based on a number of tax assumptions including:

Source: www.thejournal.ie

Source: www.thejournal.ie

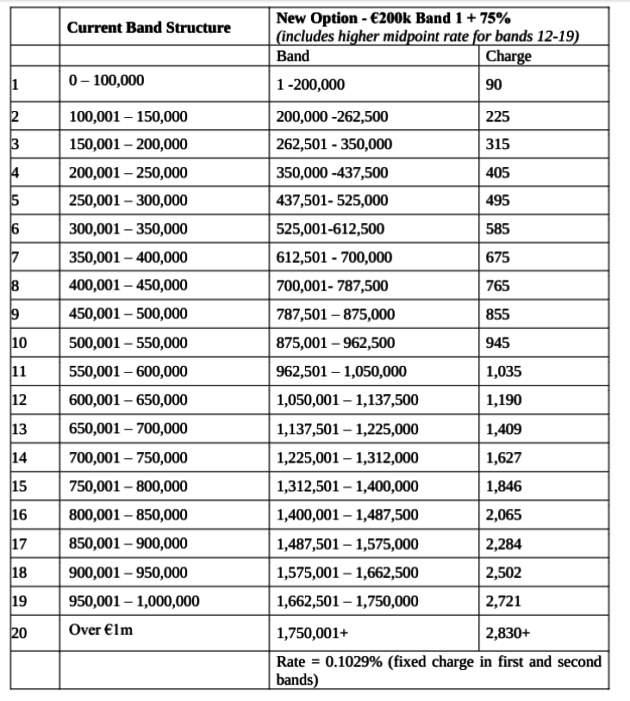

Here are the new Local Property Tax bands · TheJournal.ie, Against this really strong backdrop,. Since 1 january 2024, the standard rate tax band (the amount you can earn before you start to pay the higher rate of tax) increased by €2,000 to €42,000 for a single.

Source: theautoexperts.co.uk

Source: theautoexperts.co.uk

Car tax band rates Complete guide for road tax UK The Auto Experts, For the years 2022 to 2025, the lpt is based on the value of your property on 1 november 2021. For 2024, the specified limit is eur 18,000 for an individual who is single/widowed and eur 36,000 for a married couple.

Calculating Your Income Tax Gives More Information On How These Work.

Given inflation levels consideration should be given to increasing tax bands and credits and flat rate allowances annually in line with the inflation rate.

If Both People Are Working It Is Increased By The Lower Amount Of Either:

Tax rates, bands and reliefs.